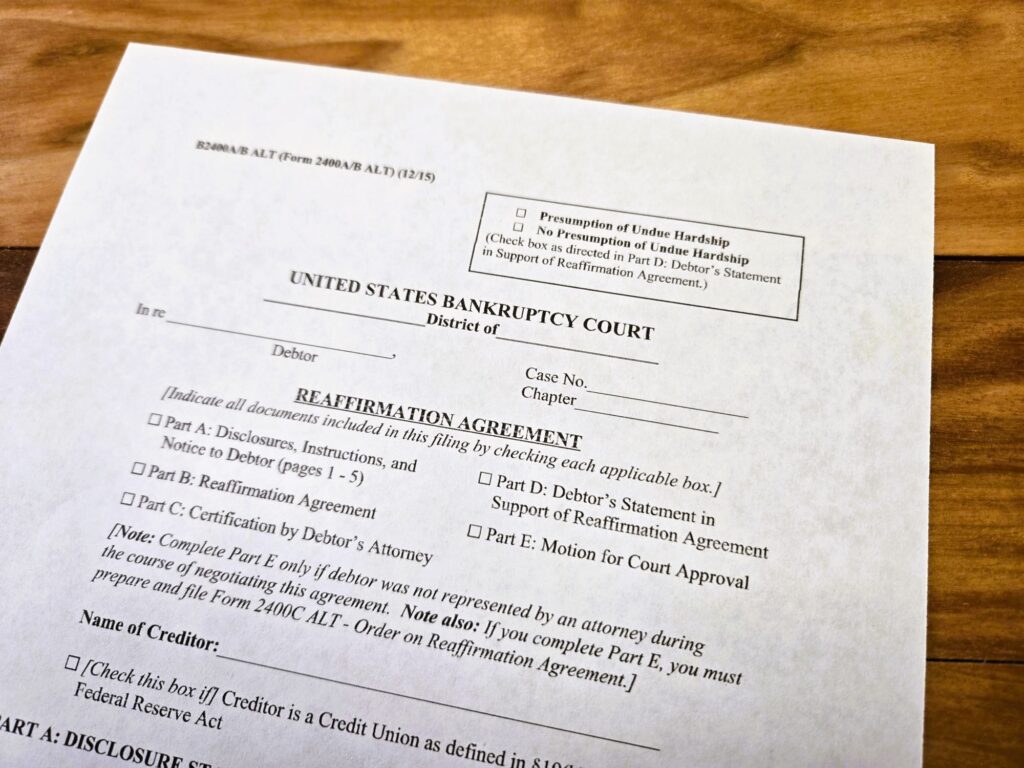

A reaffirmation agreement is a document which makes you responsible for a particular loan after the bankruptcy. The reaffirmation agreement protects the lender. If you fail to make the loan payments after the bankruptcy, then the lender can repossess the collateral securing the loan and sue you for any deficiency after selling the collateral.

The reaffirmation agreement is subject to Court approval. You must show the Court that you can afford the loan payments. Otherwise, the Court will not allow the reaffirmation agreement.

Why would anyone reaffirm a loan in bankruptcy? If the loan is secured by property which you want to retain, then the lender may require that you reaffirm the loan in order to keep the property. For instance, auto lenders often require debtors to reaffirm their auto loans in order to retain their vehicles.

While mortgage lenders may not require you to reaffirm the mortgage loan, you may wish to do so for other reasons. Communication with your mortgage lender after the bankruptcy may be more difficult absent a reaffirmation agreement.

Also, lenders will not report your payment history to the creditor bureaus absent a reaffirmation agreement. Said payment history will help you rebuild your credit score more quickly post-bankruptcy.

Bankruptcy can be very complicated. You should contact an experienced bankruptcy attorney if you are considering filing a Chapter 7 or 13 Bankruptcy case. The Law Office of Brent M. Myer, PLLC offers free consultations.

Call today for your free consultation!